Nvidia Faces Challenges in AI Chip Market Amid Rising Competition

April 22, 2025

Nvidia

AI chips

Google TPUs

Apple

semiconductor sector

market trends

Jensen Huang

stock decline

Nvidia's dominance in the AI and compute chip market is under threat due to competition from Google and Apple, market rotation, management sell-offs, and sector-wide challenges, despite its strong year-to-date performance.

Nvidia Faces Challenges in AI Chip Market Amid Rising Competition

Nvidia's dominance in the compute and AI chip market is facing significant challenges, as highlighted by recent developments and market trends. Here are the key factors contributing to this potential decline:

- Competition from Google and Apple: Apple has announced that it will train its AI models using Google's Tensor Processing Units (TPUs) instead of Nvidia's GPUs. This shift indicates a growing preference for alternative AI training solutions among major tech companies. Google's TPUs, which are cost-effective and designed specifically for AI, have been available since 2017 and are increasingly being adopted by companies like Apple for efficient and scalable AI model training.

- Market Rotation and Profit-Taking: Nvidia's stock has experienced a significant decline, dropping 26% from its June peak. This is partly due to a broader market rotation where investors are shifting from big tech companies to smaller firms in anticipation of interest rate cuts. Additionally, profit-taking after substantial gains has contributed to the stock's decline.

- Management Sell-Off: Nvidia's CEO, Jensen Huang, has sold over 3 million shares since mid-June, which may have unsettled investors. Although these sales were part of a prearranged trading plan, they can still be perceived as a lack of confidence in the company's short-term prospects.

- Sector-Wide Challenges: The semiconductor sector has been affected by various factors, including geopolitical tensions and trade policies. Former President Donald Trump's comments on trade and defense policies in East Asia have added to the sector's volatility, impacting Nvidia's stock performance.

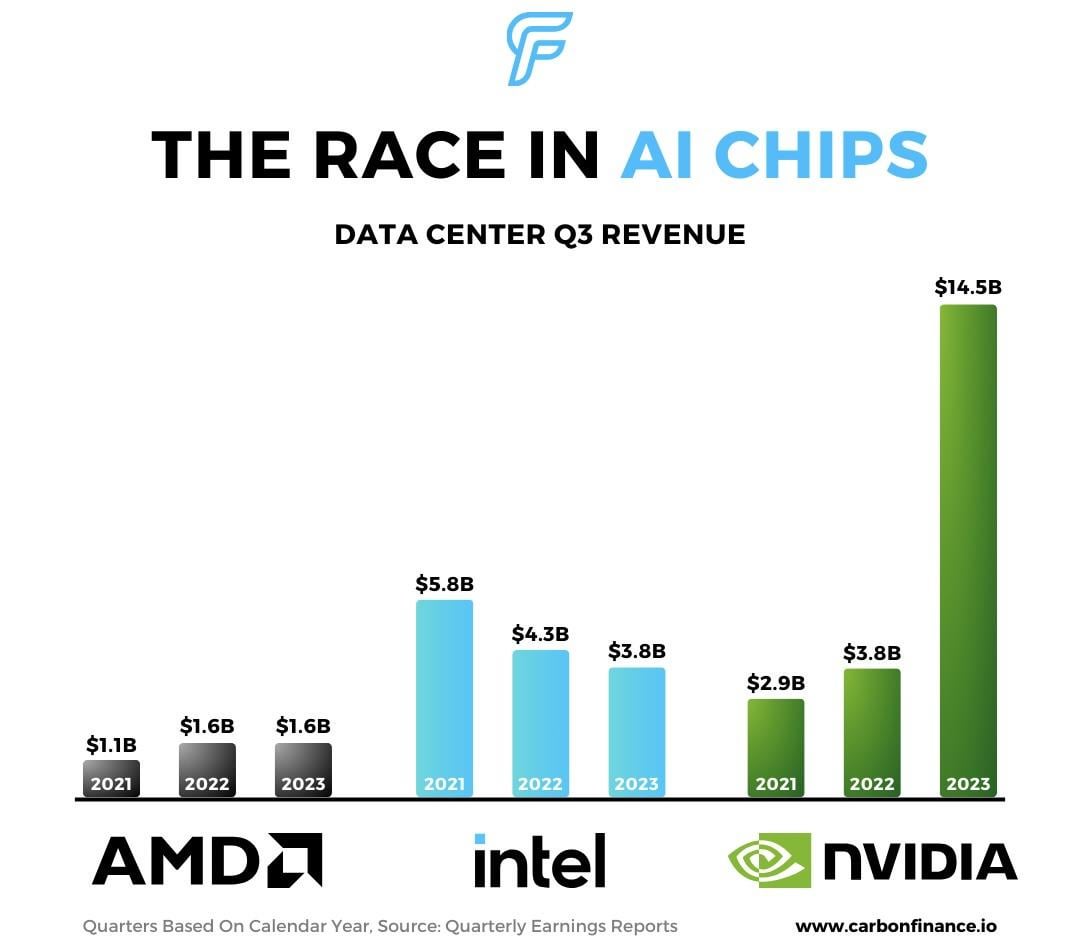

- Technological Evolution: While Nvidia is working on next-generation technologies, competitors are also advancing rapidly. The AI chip market is becoming increasingly competitive, with companies like Google and Apple developing their own solutions, potentially eroding Nvidia's market share.

Despite these challenges, Nvidia remains a significant player in the AI and compute markets, with its stock still up 110% year-to-date and 610% since the end of 2022. However, the company must navigate these headwinds carefully to maintain its competitive edge.

Sources

The Future of Compute: NVIDIA's Crown is Slipping

Demand consolidation, changing compute mix, custom silicon, and distributed training will hurt NVIDIA's pole position.

From Dominance to Decline - What Could Undermine Nvidia's Co...

$NVIDIA (NVDA.US)$'s stock fell by 7% to $103.73, significantly outpacing the $Nasdaq Composite Index (.IXIC.US)$'s 1.3% decline, marking its lowest closing ...

How Nvidia's CUDA Monopoly In Machine Learning Is Breaking

With the arrival of PyTorch 2.0 and OpenAI's Triton, Nvidia's dominant position in this field, mainly due to its software moat, is being disrupted.